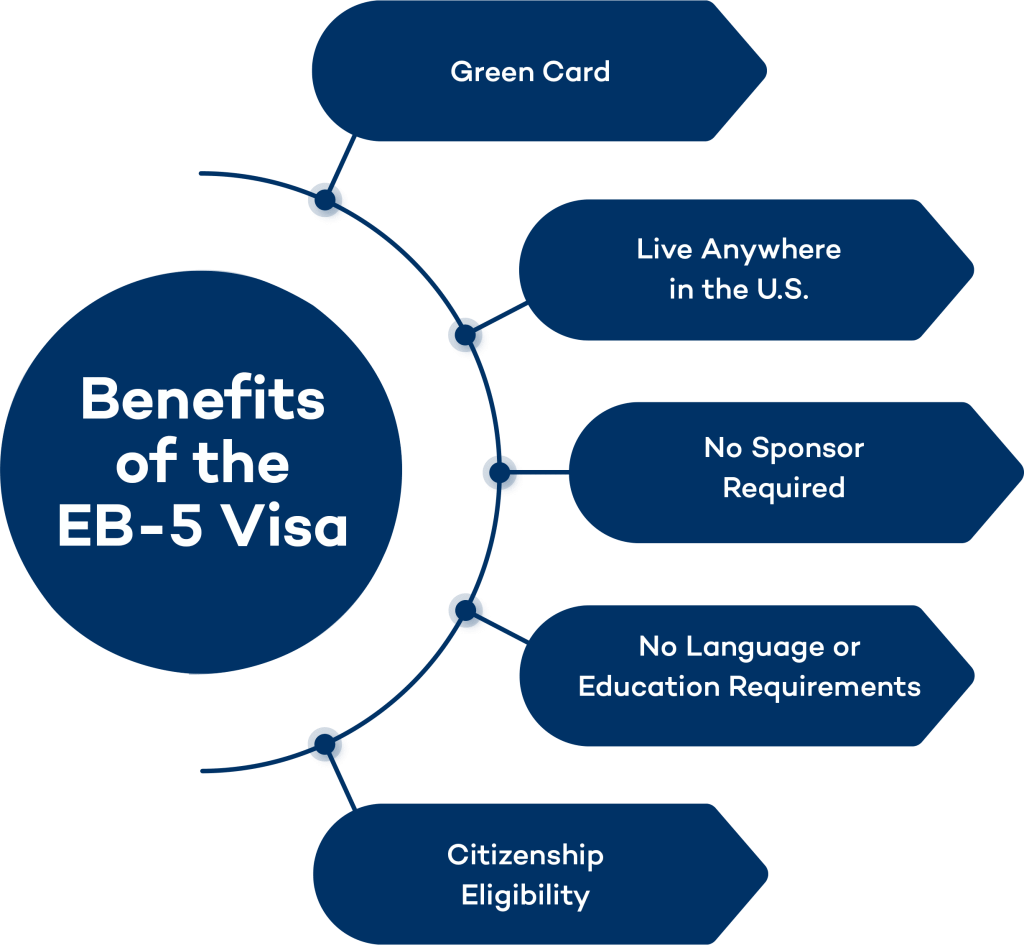

A Special Job Area (SJA), also referred to as a Targeted Employment Area (TEA), is a geographical location that offers a lower minimum investment threshold for the EB-5 Visa program. The US Citizenship and Immigration Services (USCIS) designates these areas based on high unemployment rates or low income levels. In the context of Berkeley EB-5 Investment, SJAs provide eligible investors with an opportunity to invest a minimum of $800,000 instead of the standard $1.05 million in a new commercial enterprise or a regional center.

The Role and Significance of Regional Centers in the EB-5 Visa Program: Insights from Berkeley EB-5 Investment

A Regional Center is a specific type of commercial enterprise under the EB-5 Visa program that facilitates job creation and investment in large-scale development projects. These centers pool investments from multiple EB-5 applicants and use the funds to create or preserve ten or more jobs in a high-unemployment area. The investment in a Regional Center is considered a passive investment, meaning the investor does not have to be involved in the day-to-day management of the business. However, they are still required to maintain an active role in the policy formulation and ongoing administration of the center.

Differences Between Investing in a Regional Center and Investing Directly in the EB-5 Visa Program: A Comparative Analysis from Berkeley EB-5 Investment

Investing in a Regional Center and investing directly in a new commercial enterprise under the EB-5 Visa program differ in various aspects. The most significant difference lies in the level of management involvement required from the investor. In a direct investment, the investor is expected to manage the business actively and play a hands-on role in its daily operations. In contrast, investing in a Regional Center allows the investor to maintain a passive role and focus on other business interests while still benefiting from the job creation and potential returns on investment.

Acceptable Sources of Capital for EB-5 Visa Applicants: Insights from Berkeley EB-5 Investment

To be eligible for the EB-5 Visa, applicants must demonstrate that their investment funds are lawfully sourced. Acceptable sources of capital include personal savings, sale of business or other assets, inheritance, or gifts from family members or legal entities. It is important to note that funds derived from illegal activities, such as drug trafficking or money laundering, are not considered acceptable sources of investment capital. Additionally, the investor must prove that the funds have been transferred to the United States and are readily available for investment.